So 2021 is now history and we can look back at what worked last year and plan for the new year in the markets.

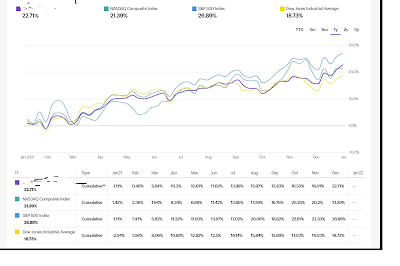

Last year was a relatively good year. My main portfolio rose just over 22% from the beginning of January until the end of December. It beat both the Dow Jones Industrial index and the NASDAQ index. It lagged the S&P 500 by a few percentage points but two out of three isn't that bad.

My M1 account has now topped $5,000 and is cash flowing just over $28 per quarter. The cash snowball is building fast on that front with just over $120 earned in almost two years.

You can see my M1 portfolio here. If you use this link and fund a new account with just $100 both you and I will receive a $30 bonus, so you begin your account with a 30% profit before your fist trade is made.

On the crypto front, I have two accounts. One with Block Fi where I have staked my crypto funds. There is a good return coming in there, in just six weeks I have earned over $1 on just over one hundred dollars of stked crypto. Items like Bitcoin, Cosmos and Etherium.

Staking is easy just create an account and place your crypto currency in the pool then in a few hours you will see your account receive interest on your money. At the end of the month the income is then added to your account so the funds compound quickly. To open a Block Fi account go here If you open an account with this link both of us will receive a bonus payment of bitcoin.

My other crypto account is with Coinbase. This account has some ability to stake your crypto currency but also lets you earn new crypto by taking simple tests. I have earned about $36 in coins just taking a simple quiz which comes up on the site about every ten days. A dollar here and there helps boost those staked earnings.

To open a Coinbase account go to here. We will also both earn a bonus amount of approximately $10 in Bitcoin when you fund your new account.

Going back to my stock portfolio. This being a new year I took the opportunity to take a look at my dividend yield for the next year. This being the yield on cost I took the estimated dividend for the next year and then divided this by the total cost of my portfolios. The actual price that I have paid, not the value of the stock at todays market price.

My original yield on cost four years ago was around 2.1% that was about the same as the S&P yield.

My yield on cost on January 1, 2022, was 4.17%.

This growth has come from my long holding time, some stocks have been there since 2006. Plus last year saw lots of my companies increasing their dividends.

A thing to remeber is when you buy a stock and it pays a dividend you receive that percentage yield on the stock for as long as the stocks pays a dividend or the stock increases its dividend, when such an increase occurs your price paid remains the same, but your yield on cost increases dramatically.

My Apple stock, AAPL pays only about 0.4% buying at todays prices of around $170. I have owned AAPL since 2006 so my cost per share is less than $50 the yield of AAPL for me is 1..76% and will grow as AAPL grows its dividend.

Well that's all for now. Thanks for reading and please consider opening accounts at M1, Block Fi or Coinbase, their bonus payments are genuine, and once opened you too can share links which will earn you some side income if you share a link.

Also thank you for supporting me with purchases from my Amazon Store. Take a look at the latest offers here.